Harley Davidson India Finance

The next step in our Internal analysis of Harley-Davidson Inc.

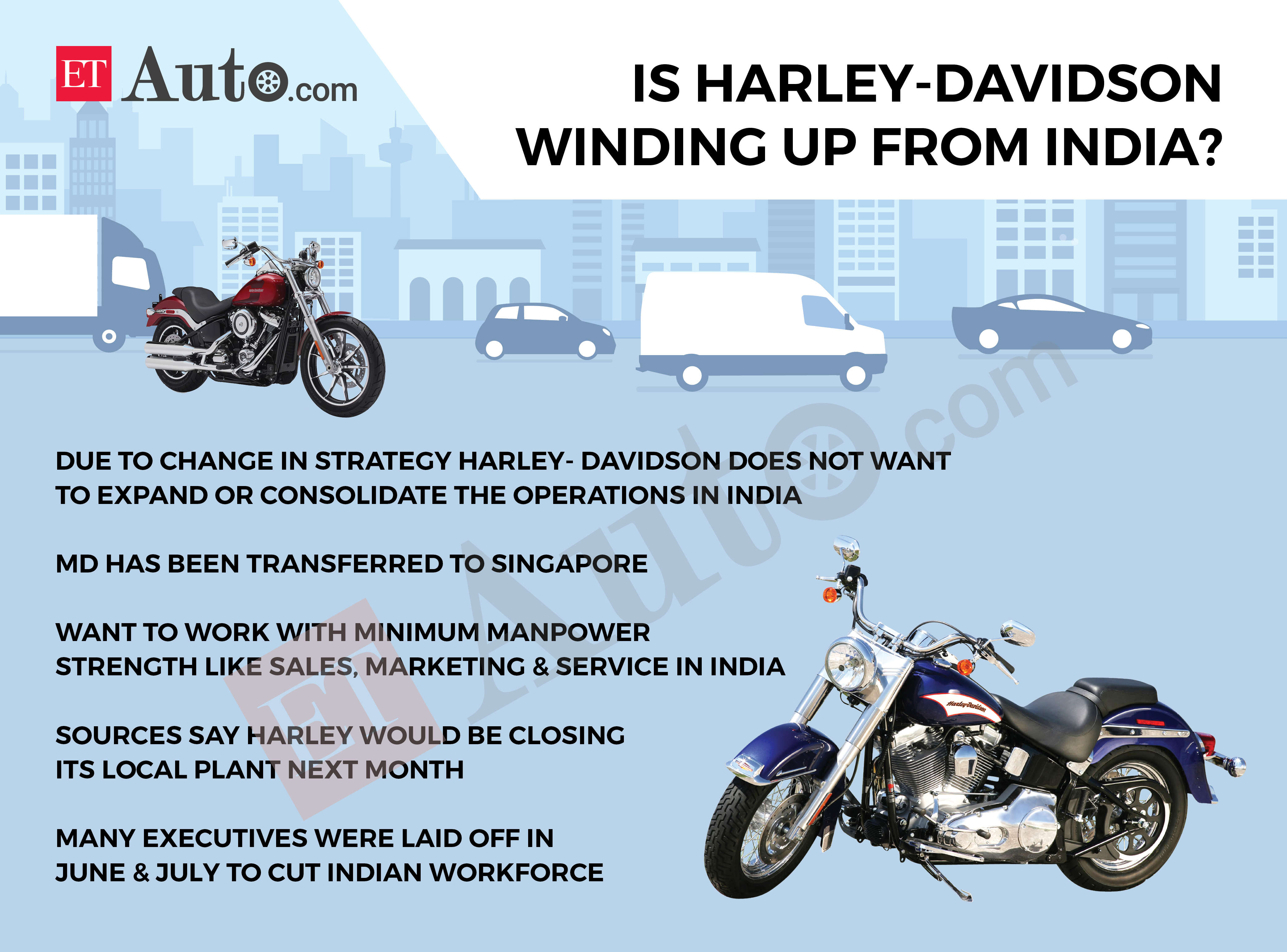

Harley davidson india finance. Harley-Davidson plans to shut down its assembly unit in Bawal Haryana state and lay off 70 employees. Despite an almost cult-like following in several markets besides the US Harley-Davidson has been facing financial difficulties for quite some. The Hardwire is designed to enhance the desirability of Harley-Davidson and fuel our unique lifestyle brand.

Published by Statista Research Department May 10 2021. Harley-Davidson placed emphasis on its manufacturing operations and in 2011 Harley-Davidson had 15 main facilities located in the US India Brazil and Australia Grant 523 528-30. Why is Harley-Davidson exiting the Indian market.

Harley-Davidson reimburses dealers for performing manufacturer-specified pre. The function of Harley-Davidson Financial services is dealing with the dealers and providing finance to them and to spread in the regions like US Canada and EuropeThe line of the US motorcycle consisted of five different basic models coming in several versions and having price between 8000 and 37000. Harley-Davidson India commenced operations in August 2009 and appointed its first dealership in July 2010.

Proficient in budgeting planning and auditAccounts receivable Accounts payableTDS GST returns Auditing Fixed assets Compliance. The Motorcycles and Related Products segment designs manufactures and sells cruiser and touring motorcycles for the heavyweight market. And in FY2021 it fell to just 680 units - the decline was about 1185 units.

It operates in two segments Motorcycles and Related Products and Financial Services. Youll get your decision in minutes. The APR may vary based on the applicants past credit performance and the term of.

Harley-Davidson Finance is a program of H-D Motor Company India Pvt Ltd HDMCI. Technology skills brand and reputation. Thats steep for a market where the average bike with decent mileage starts at 50000 rupees and its nearest competitor.